Understanding Post Office Interest Rates: Tables and Calculation Methods

The post office not only serves as a convenient location for shipping letters and parcels, but it also provides a variety of financial services, such as savings accounts and fixed deposits. Individuals may use these services to increase their wealth while also assuring the protection of their cash.

In this piece for the blog, we will look at post office interest rates, as well as the tables that define these rates and the procedures used to calculate them. Understanding these factors will enable people to make more educated decisions and maximize their savings potential.

Post Office - The Importance of Interest Rates

Interest rates are critical in financial planning and decision-making. They determine the return on investment and the growth of savings over time.

As a reputable organization, the post office provides reasonable interest rates. To capitalize on the opportunities presented by these rates, it is critical to understand how they are constructed and computed.

Post Office Interest Rate Tables

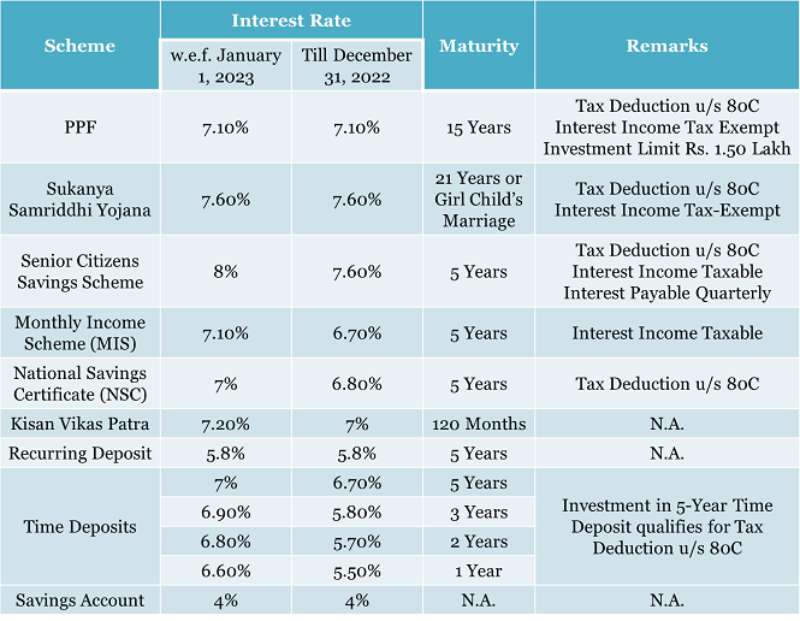

Post office interest rates are often shown in extensive tables that describe the various investment alternatives and accompanying rates.

These tables provide a comprehensive summary of the interest rates available on various types of savings accounts and term deposits. They frequently categorize interest rates based on the period of the investment, which can include short-term, medium-term, and long-term.

Other essential information, such as minimum deposit requirements, lock-in periods, and any extra perks or incentives given, is also detailed in the tables. It is critical to consult these tables on a frequent basis to remain up to speed on current rates and to pick the best investment option based on your financial objectives.

Calculation Methods

Knowing how interest rates are calculated is important for perfectly estimating investment growth and making informed decisions. The post office typically employs two calculation methods: simple interest and compound interest.

Simple Interest

Simple interest is computed just on the principal amount, without taking into account any accrued interest. The following is the formula for computing simple interest:

(Principal Amount Interest Rate Time Period) / 100 = Simple Interest

For example, if a person puts Rs. 10,000 in a post office savings account with a 5% annual interest rate for one year, the resultant amount is:

Simple Interest = (10,000 5 1) / 100 = 500 Rs.

Compound Interest

Compound interest considers both the principal and the accrued interest. Compound interest is calculated using the following formula:

Compound Interest = [(1 + Interest Rate / 100) Time Period - 1] Principal Amount

For example, if a person puts Rs. 10,000 in a post office fixed deposit with a compound interest rate of 6% compounded annually for three years, the compound interest calculation is: Compound Interest = 10,000 [(1 + 6 / 100) 3 - 1] = Rs. 1910.16

It is important to note that the frequency of compounding varies based on the investment scheme. The post office often provides yearly, quarterly, or monthly compounding choices, which can have a major influence on the ultimate interest received.

You should also consider reading:- Free Online Courses With Certificates In India

Factors Affecting Post Office Interest Rates

Interest rates at post offices are impacted by a number of factors, including current economic conditions, government policies, inflation rates, and competition from other financial institutions.

Economic variables, such as the overall interest rate environment and financial market stability, can have an influence on post office rates.

Interest rates can be influenced by government policies, particularly those relating to monetary policy and regulation.

Inflation rates are important because they degrade the buying power of money, causing interest rates to fluctuate.

Finally, competition from other financial institutions forces post offices to present competitive rates in order to recruit consumers and maintain market share.

These elements all have a role in determining post office interest rates.

Types of Post Office Savings Schemes

To meet the differing financial needs of individuals, post offices provide a variety of savings programmes with varying interest rates. Some frequent schemes include:

Post Office Savings Account: This is a basic savings account with a reasonable interest rate and convenient withdrawal and deposit of cash.

Post Office Recurring Deposit Account: This is a monthly savings plan in which consumers deposit a preset amount every month for a set period of time, often 5 to 10 years. The interest rates are fixed and fluctuate depending on the deposit duration.

Post Office Time Deposit Account (fixedDeposit): These accounts have set tenures of one, two, three, or five years, with commensurate interest rates. The longer the loan term, the greater the interest rate.

senior Citizen Savings plan: This plan is particularly created for older citizens and provides a greater interest rate than conventional savings accounts. It has a set 5-year term and allows persons aged 60 and up to invest significantly.

Also Read - How To Check Delhi Metro Card Balance

Understanding Interest Rate Table Components

Individuals should be aware of the following components of post office interest rate tables in order to make instructed investing decisions:

Investment Scheme: The table will show the various savings plans available from the post office, such as savings accounts, recurring deposits, fixed deposits, and so on.

Duration/Tenure: The table will include the tenure or duration choices available for each plan. It is critical to select a time frame that corresponds to your financial objectives.

Interest Rates: The table will provide the relevant interest rates for each scheme and tenure. Rates may change depending on market circumstances and government policy.

Compounding Frequency: For each scheme, the table may additionally provide the compounding frequency, such as yearly, quarterly, or monthly. The compounding frequency governs how frequently interest is applied to principal.

Minimum Deposit: Some schemes may need a minimum deposit. This is the bare minimum that individuals must invest in order to get the advantages of the plan.

You may also like to read - How Late Is The Closest Grocery Store Open

Checking and Comparing Interest Rates

To get the most of post office savings plans, it is important to review and compare the interest rates presented in the tables on a frequent basis. Here are a few things to think about:

Up-to-Date Information: Because interest rates fluctuate on a regular basis, it is important to consult the most recent versions of the interest rate tables accessible on the official post office website or visit the local post office branch to acquire the most up-to-date information.

Comparative Analysis: By comparing the interest rates given by various post office schemes, consumers can determine the best solution for their investment goals and risk tolerance.

extra Benefits: In addition to interest rates, it is vital to analyse any extra benefits provided by special schemes, such as tax breaks, withdrawal flexibility, or lending facilities against deposits.

External Benchmarking: Comparing post office interest rates to those given by other financial institutions can give people a broader perspective from which to make informed decisions.

You may also like to read - Ajio rs 500 off on 1250 coupon code

Post office interest rate tables offer a detailed overview of the numerous savings plans available, as well as their relative interest rates and other important facts. Individuals may make educated decisions to maximize their savings potential and achieve their financial objectives by knowing the various types of plans, the components of the interest rate table, and routinely reviewing and comparing rates.

Consider Reading:-

- Amazon Credit Card Bill Quiz: Answers and Benefits

- Shoe Size Chart India

- Best Dry Fruits Brand In India

- Best Trimmers For Men Under 1000